By Simi George

The New York Public Service Commission recently approved plans by National Grid, the largest distributor of natural gas in the Northeast, to use advanced leak detection and quantification technologies developed by EDF and Google Earth Outreach in order to maximize the environmental and ratepayer benefits of a three-year, $3 billion capital investment program. This program includes plans to replace 585 miles of old, leak-prone pipes on the company’s systems in Long Island and parts of New York City.

The New York Public Service Commission recently approved plans by National Grid, the largest distributor of natural gas in the Northeast, to use advanced leak detection and quantification technologies developed by EDF and Google Earth Outreach in order to maximize the environmental and ratepayer benefits of a three-year, $3 billion capital investment program. This program includes plans to replace 585 miles of old, leak-prone pipes on the company’s systems in Long Island and parts of New York City.

The Commission’s December 16 order marks a major step forward in EDF’s efforts to accelerate the diffusion of environmentally beneficial technologies – in this case cutting edge methane emission measurement tools – by natural gas utilities.

Speeding the Process

Typically, the adoption of new technologies starts gradually, led by a few visionary leaders. Over time, with the right market and regulatory conditions, the use of beneficial technologies spreads, leading eventually to adoption at a broader scale.

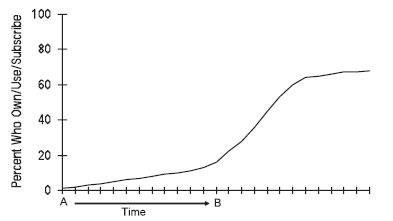

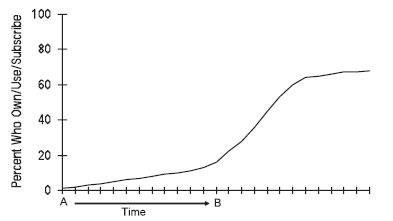

The typical technology diffusion curve representing the cumulative use of a new technology over time looks like this:

Source: Carey et al., When Media Are New: Understanding the Dynamics of New Media Adoption and Use (2010)

With the help of collaborators in the utility sector, along with our partners at Google Earth Outreach and Colorado State University, we’ve seen the industry move steadily along the technology diffusion curve toward the point at which best practice is adopted by a critical mass of utilities, before eventually becoming standard practice.

National Grid will consider methane emissions data drawn using advanced leak detection and quantification methods to identify and address the leakiest sections of its gas infrastructure first, which will reduce methane emissions much faster than otherwise possible. Methane, the main ingredient in natural gas, is a greenhouse gas, over 80 times more potent than carbon dioxide over a 20-year timeframe.

The company also plans to develop the means to quantify methane emissions released from its system on an ongoing basis. National Grid is the first utility to make a commitment to using these new methods on an ongoing basis, and to explore integration of these methods into its operations at scale.

Collaboration & Incentives

The Public Service Commission also blessed National Grid’s plans to collaborate with EDF on a series of pilot projects aimed at reducing methane emissions from its distribution system in New York. In approving these pilot projects, the Commission noted:

“It is unique for proposed pilot programs to be predicated on goals that provide benefits to the utilities, their ratepayers, and the environment and to come at no cost to ratepayers. We commend the parties in agreeing on these programs and encourage them to begin collaborating immediately in an effort to implement the programs […] as soon as possible. We look forward to the results of these programs.”

Under the terms of the final order, National Grid will receive financial incentives for exceeding annual leak repair and pipe replacement targets. By connecting the utility’s leak abatement performance to its bottom line, the Commission has created a powerful impetus for the acceleration of its leak abatement and pipe replacement efforts – a framework that could serve as a model for other jurisdictions.

This order represents a new milestone in EDF’s advocacy efforts by creating a pathway for the integration of advanced leak detection and quantification methods into a major utility’s operations, building on other recent precedents advanced by EDF.

A Growing Trend

Utilities are required by law to monitor their systems for hazardous leaks, and fix them quickly. But hundreds of other leaks that are deemed non-hazardous can persist for months or years on end. Our collaborations with gas utilities, centered on the diffusion of new, beneficial technologies to minimize methane emissions, are moving the ball forward in the utility industry. By making it possible for gas utilities to identify and prioritize the leakiest sections of their infrastructure as part of leak abatement efforts, advanced leak detection and quantification technologies are delivering substantial environmental and ratepayer benefits.

In November 2015, the New Jersey Board of Public Utilities approved plans by PSE&G, New Jersey’s largest utility, to use methane emissions data gathered by EDF to prioritize a $905 million, three-year pipe replacement program, making it the first utility to do so. This new approach allowed PSE&G to reduce as much as 83% of its methane emissions early while replacing one-third fewer miles of gas lines than under a business as usual scenario.

Earlier this year, EDF successfully completed a pilot project with Con Edison, another major New York utility, in which methane data gathered by EDF was used to identify and address the largest non-hazardous leaks on its system. Using the data, we found that more than half of the emissions could be eliminated by addressing the largest 18% of the leaks.

Other major utilities including CenterPoint Energy and Pacific Gas & Electric are independently exploring the integration of such technologies into their operations.

In the coming year, EDF will focus its efforts on facilitating further diffusion of advanced leak detection and quantification technologies in the utility sector to advance our overarching objective of minimizing methane emissions from the oil and gas sector. This will take time, but we’re well on our way.

Read more

By

By

The New York Public Service Commission recently approved plans by National Grid, the largest distributor of natural gas in the Northeast, to use advanced leak detection and quantification technologies developed by EDF and Google Earth Outreach in order to maximize the environmental and ratepayer benefits of a three-year, $3 billion capital investment program. This program includes plans to replace 585 miles of old, leak-prone pipes on the company’s systems in Long Island and parts of New York City.

The New York Public Service Commission recently approved plans by National Grid, the largest distributor of natural gas in the Northeast, to use advanced leak detection and quantification technologies developed by EDF and Google Earth Outreach in order to maximize the environmental and ratepayer benefits of a three-year, $3 billion capital investment program. This program includes plans to replace 585 miles of old, leak-prone pipes on the company’s systems in Long Island and parts of New York City.